The Wise Card is a debit card designed for easy spending across multiple currencies, making it ideal for travelers, freelancers, and online shoppers.

It offers real exchange rates with low fees, helping you avoid hidden charges from traditional banks.

In this guide, you’ll learn how to apply for the Wise Card and why it’s one of the best multi-currency options available today.

What Is the Wise Card?

The Wise Card is a debit card connected to your Wise multi-currency account. It allows you to hold and spend in over 40 currencies.

It allows you to pay in over 160 countries with automatic currency conversion at the real mid-market exchange rate.

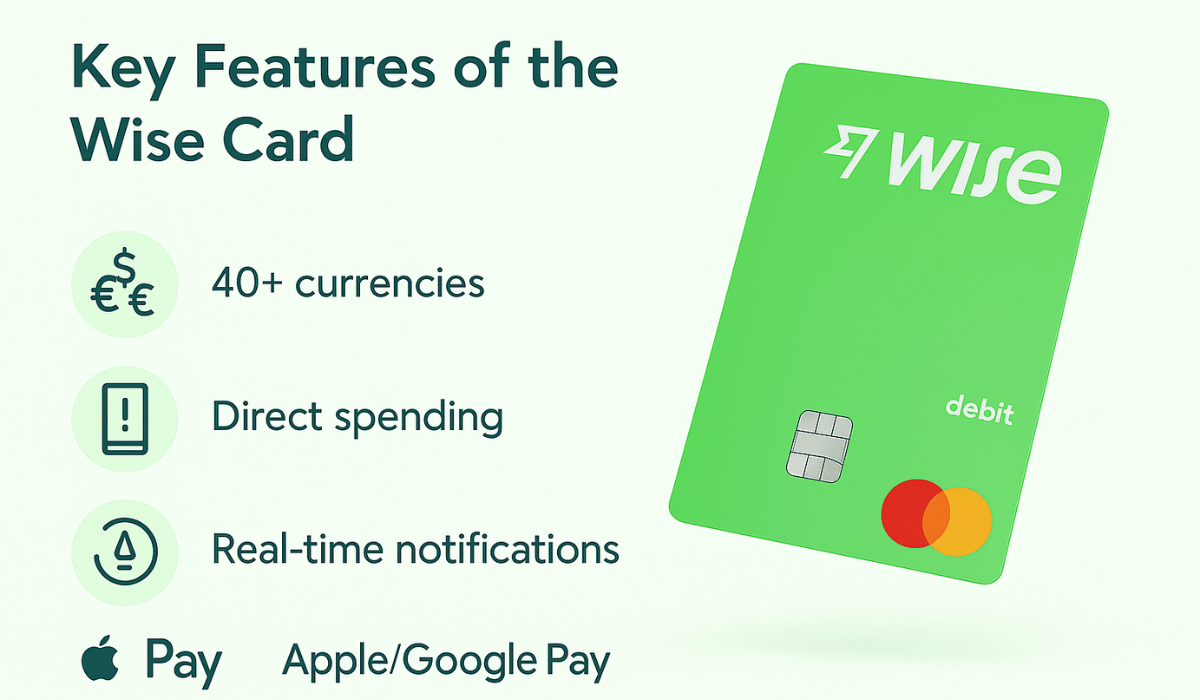

Key Features

The card offers practical features designed for people who spend, travel, or get paid internationally. Here’s what makes it stand out:

- Multi-Currency Support: Hold and convert over 40 currencies in one account.

- Real Exchange Rates: Utilizes the mid-market rate, eliminating hidden markups.

- ATM Withdrawals: Withdraw up to a set monthly limit for free; a small fee applies after the limit is reached.

- Mobile Wallets: Works with Apple Pay and Google Pay for contactless payments.

- Instant Notifications: Get real-time alerts for every transaction.

- Complete App Control: Freeze or unfreeze your card, set spending limits, and track usage.

- No Monthly Fees: Pay only for what you use—no maintenance or inactivity charges.

- Fast Delivery: Receive your physical card within days, depending on your location.

Why You Should Apply

This multi-currency card is designed to simplify and reduce the cost of international spending. Here are the main reasons to consider getting it:

- Lower Fees: Enjoy low conversion fees and no hidden charges.

- Real Exchange Rates: Spend abroad using the mid-market rate, not inflated bank rates.

- Global Access: It can be used in over 160 countries without separate accounts.

- Ideal for Travelers: Easily manage spending while abroad with complete app control.

- Perfect for Freelancers: Get paid in different currencies and spend directly from your balance.

- Safe and Secure: Freeze your card instantly and track real-time activity.

- Easy to Use: Manage everything from one app with simple tools and fast setup.

Who Can Apply

The Wise Multi-Currency Card is available to personal customers residing in specific countries. To be eligible, you must meet the following criteria:

Residency: You must reside in one of the eligible countries, which include:

- Australia

- Brazil

- Canada

- European Economic Area (EEA) countries and Switzerland

- Japan

- Malaysia

- New Zealand

- Philippines

- Singapore

- United Kingdom

- United States (excluding residents of Nevada)

Age Requirement:

- You must be at least 18 years old.

Wise Account:

- You need to have an active Wise account.

Verification:

- You must complete identity verification, which typically involves providing:

- A valid government-issued photo ID (e.g., passport, national ID card, or driver’s license).

- Proof of address (e.g., utility bill, bank statement, or government-issued document).

Please note that Wise has temporarily paused the issuance of new multi-currency cards for business customers in the U.S.

You can apply for the Wise Multi-Currency Card through your Wise account if you meet these requirements.

How to Apply for the Wise Card

Getting this card is simple and can be done online or through the mobile app. Here’s a quick step-by-step guide:

- Create an Account: Sign up on the Wise website or app using your email address or social login credentials.

- Verify Your Identity: Upload a valid photo ID and proof of address to confirm your identity.

- Order the Card: Go to the ‘Cards’ tab and request your physical card. A small one-time fee applies.

- Wait for Delivery: Delivery time varies depending on your location, typically between 3 and 21 business days.

- Activate Your Card: Use the provided code or complete a PIN transaction to activate it.

- Start Using It: Load funds, make purchases, withdraw from ATMs, or link to Apple Pay/Google Pay.

Fees and Limits

The card keeps pricing simple with no hidden charges. Below is a clear summary of the main fees and limits you need to know:

- Card Fees

- Issuance Fee: One-time fee (e.g., $9 in the U.S.).

- Replacement Fee: Around $5 if you lose your card.

- Virtual Card: Free to create and use.

- ATM Withdrawal

- Free Limit: 2 free withdrawals per month, up to $100.

- After Limit: $1.50 per withdrawal + 2% on amounts over $100.

Spending Limits

- Single Transaction: Limits depend on your country (e.g., ₱500,000 in the Philippines).

- Daily ATM Withdrawals: Up to $250 by default in the U.S., with a max of $1,000.

- Monthly ATM Limit: Up to $1,500 by default in the U.S., with a max of $6,000.

- Annual Limit (Singapore): SGD 100,000.

Currency Conversion and Exchange Rates

One of the strongest features of the Wise Card is how it handles foreign currency.

It offers a transparent system that saves you money when making international purchases. Here’s how it works:

- Mid-Market Exchange Rate: You get the real mid-market rate you see on Google.

- No Hidden Markups: Unlike banks, Wise doesn’t inflate exchange rates.

- Low Conversion Fees: Charges range between 0.35% and 2%, depending on the currency.

- Auto Conversion: Wise automatically converts from the lowest-cost available balance if you don’t have enough in one currency.

- Multi-Currency Wallet: Hold over 40 currencies and convert only when needed.

- Preview Before You Pay: You’ll always see the exchange rate and fee before completing a transaction.

Wise Virtual Card Option

The Wise virtual card is a secure and convenient way to make online and mobile payments without using your physical card.

It’s available once you’ve ordered the physical card and verified your account. Here’s what you need to know:

- Instant Access: Get a virtual card right after your physical card is ordered—no need to wait for delivery.

- Online Payments: Use it for secure online purchases and app subscriptions.

- Enhanced Security: Protects your real card details and helps reduce fraud risk.

- Create and Delete Easily: Generate new virtual cards instantly or delete them anytime from the Wise app.

- Works with mobile wallets: It is compatible with Apple Pay and Google Pay for contactless payments.

- Separate Card Numbers: It has a different number than your physical card, adding an extra layer of protection.

Wise Contact Information

If you need assistance with your Wise account or have questions about the Wise Card, here are the main ways to get in touch:

- Help Center: Visit Wise Help Center for FAQs and support articles.

- Phone Support (U.S.): Call +1 888 501 4041. Lines are open 24/7.

- Phone Support (UK): Call +44 808 175 1506 (toll-free from UK numbers).

- Email Support: Log in to your Wise account and use the in-app email option for personalized assistance.

- Mailing Address (U.S.): 30 W 26th St, New York, NY 10010.

To Sum Up

The Wise Card offers a simple and affordable way to manage multiple currencies while spending or traveling abroad.

With real exchange rates, low fees, and global usability, it’s a smart choice for anyone dealing with international payments.

If you’re ready to save money and gain full control over your spending, apply for your Wise Card today.

Disclaimer

Information in this article is based on publicly available sources and may change depending on your location and Wise’s current policies.

Always refer to Wise’s official website for the latest terms, fees, and eligibility requirements.